how to read stock charts for beginners pdf

Understanding the Basics of Stock Charts

Stock charts visually represent a stock’s price over time, helping traders identify trends, patterns, and potential trading opportunities. They display highs, lows, and price movements, enabling analysis of market behavior and decision-making.

What Are Stock Charts?

Stock charts are visual representations of a stock’s price and trading activity over time. They display price data, such as highs, lows, and closing prices, using formats like line, bar, or candlestick charts. These tools help traders analyze trends, identify patterns, and make informed trading decisions. By studying stock charts, investors can gain insights into market behavior and potential opportunities.

Types of Stock Charts: Line, Bar, and Candlestick

Stock charts are available in three primary forms: line, bar, and candlestick. Line charts show closing prices over time with a simple line. Bar charts display price ranges, including highs, lows, and closing prices, for each period. Candlestick charts provide detailed price action, with colors indicating upward or downward movements. Each type offers unique insights, helping traders analyze market trends and patterns effectively.

Key Components of a Stock Chart

A stock chart typically includes a price axis on the right and a time axis at the bottom. Vertical lines represent price ranges, with highs and lows marked. Volume is often shown below the price chart, indicating trading activity. Additional elements like moving averages or indicators can be added to enhance analysis. These components collectively provide a comprehensive view of a stock’s performance over time.

How to Interpret Price Action

Price action reveals market sentiment through trends, reversals, and continuations, helping traders predict future movements by analyzing patterns, highs, lows, and volume shifts.

Reading Highs and Lows

Highs and lows on stock charts indicate the peak and trough prices during a trading period. They help identify potential reversals, continuations, or breakouts. By analyzing these points, traders can spot trends, support, and resistance levels, making informed decisions. Highs show buying pressure, while lows reflect selling activity, guiding traders in predicting future price movements and market behavior effectively.

Identifying Trends in Stock Charts

Trends in stock charts show the direction of price movements over time, helping traders predict future behavior. Uptrends indicate rising prices, while downtrends signal falling prices. Sideways trends show stable prices. By identifying trends, traders can make informed decisions, such as buying during uptrends or selling during downtrends, aligning their strategies with market momentum and improving trading outcomes effectively.

Understanding Gaps in Price Action

Gaps in stock charts occur when a stock opens significantly higher or lower than its previous close, creating a price “gap.” These gaps indicate high trading interest and potential market shifts. Common gap types include breakaway, runaway, and exhaustion gaps. Analyzing gaps helps traders identify strong price movements and make informed decisions about entering or exiting trades, enhancing their market strategies effectively.

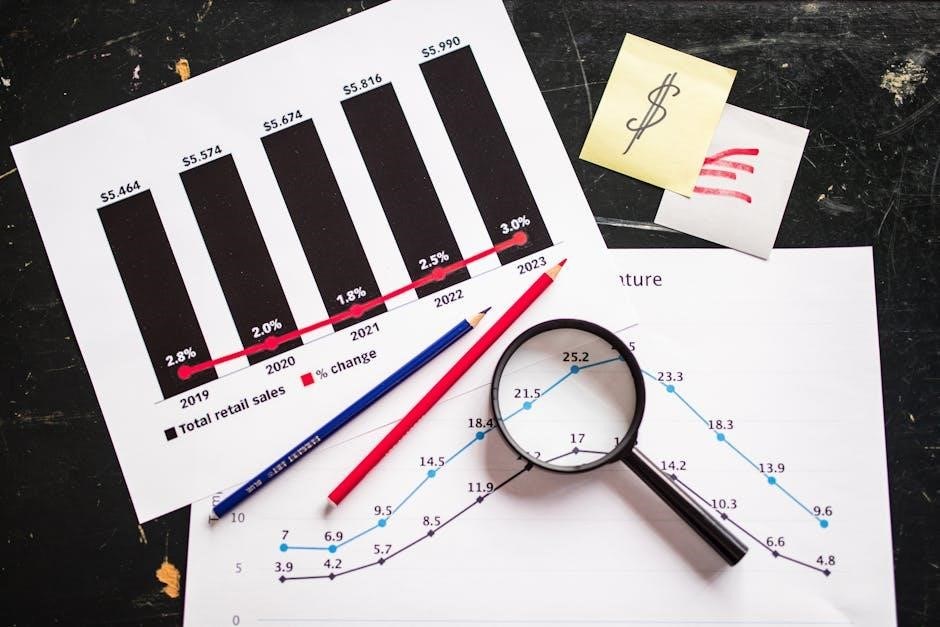

Volume Analysis

Volume analysis examines trading activity to gauge market strength and sentiment. It helps identify trends, confirm price movements, and spot potential reversals by assessing buying or selling pressure.

Why Volume Matters in Stock Charts

Volume indicates the strength of price movements and market sentiment. High volume often confirms trends, while low volume may signal weakness or indecision. It helps traders assess the reliability of price patterns and identify potential breakouts or reversals. By analyzing volume trends, traders can make more informed decisions about entering or exiting trades.

How to Analyze Volume Trends

Analyzing volume trends involves observing how volume changes over time relative to price movements. Increasing volume with rising prices often signals strength, while decreasing volume may indicate weakening momentum. Divergences, where volume moves opposite to price, can signal potential reversals. Additionally, comparing volume during rallies and declines helps assess market conviction and identify profitable trading opportunities.

The relationship between volume and price is crucial for understanding market dynamics. Rising prices accompanied by increasing volume indicate strong buying interest, while falling prices with high volume suggest selling pressure. Conversely, price movements without significant volume changes may lack conviction. This relationship helps traders confirm trends, identify potential reversals, and make informed decisions based on market strength or weakness. Support and resistance levels are key areas where stock prices tend to pause or reverse. Support is where buying interest is strong enough to stop price declines, while resistance is where selling pressure halts upward movements. These levels help traders identify potential price barriers and opportunities for entering or exiting trades. Support levels are prices where buying interest is strong enough to prevent further declines, often indicating a demand zone. Resistance levels are prices where selling pressure halts upward movements, signaling supply zones. These levels are crucial for identifying potential trend reversals or continuations, helping traders make informed decisions. They form the foundation of many trading strategies and are visually identified on stock charts. Key levels on a chart, such as support and resistance, are determined by observing consistent price behavior over time. These levels often occur at round numbers, previous highs/lows, or gaps. Traders use these levels to predict where price reversals or breakouts may happen, aiding in setting stop-loss and take-profit targets. Identifying these levels requires practice and careful analysis of historical price data. Support and resistance levels are crucial in shaping trading decisions. They help identify potential entry and exit points, allowing traders to set realistic targets. When a stock approaches resistance, it may indicate a selling opportunity, while nearing support could signal a buy. These levels also guide risk management by setting stop-loss orders, minimizing losses if the price breaks through these key points unexpectedly. Chart patterns, like triangles and wedges, provide insights into potential market movements. These formations help traders predict reversals or continuations, aiding in informed decision-making. Reversal patterns signal potential trend changes. Common examples include head-and-shoulders, inverse head-and-shoulders, and double tops/bottoms. These formations indicate weakening trends and possible shifts in market direction. Identifying them early helps traders plan exits or entries, aligning strategies with emerging market dynamics. Mastery of these patterns enhances predictive accuracy and informed decision-making in trading. Continuation patterns, like triangles and rectangles, indicate pauses in trends, signaling their likely resumption. These formations help traders confirm the strength of existing trends, allowing for strategic entries and exits. Recognizing them enables traders to align with market momentum, enhancing trading consistency and profitability. Understanding these patterns is crucial for beginner traders aiming to improve their chart analysis skills effectively. Chart patterns provide actionable insights for traders by signaling potential price movements. By identifying these patterns, traders can set strategic entry and exit points, manage risk, and optimize profits. Combining patterns with indicators enhances reliability, helping traders make informed decisions aligned with market trends. This approach is essential for beginners to develop a systematic and effective trading strategy over time. Technical indicators are tools used to analyze stock charts, helping traders predict price movements by identifying trends, momentum, and potential reversals. They simplify complex data into actionable insights.Volume and Price Relationship

Support and Resistance Levels

Defining Support and Resistance

Identifying Key Levels on a Chart

How Support and Resistance Impact Trading Decisions

Common Chart Patterns

Recognizing Reversal Patterns

Identifying Continuation Patterns

How to Use Chart Patterns for Trading

Technical Indicators

Understanding RSI and Other Momentum Indicators

The Relative Strength Index (RSI) measures a stock’s price momentum, identifying overbought or oversold conditions. Other indicators like MACD and Stochastic Oscillator also assess momentum by comparing closing prices to price ranges. These tools help traders spot potential reversals and trend strengths, aiding in timing entries and exits effectively. They complement moving averages for comprehensive analysis.

How to Apply Indicators to Stock Charts

Indicators like moving averages and RSI can be added to stock charts to identify trends and potential trading signals. Traders often overlay these tools on price data to spot patterns and confirm trends. By combining multiple indicators, traders can enhance their analysis, making informed decisions based on both technical and momentum factors. This approach helps in creating a robust trading strategy.

Risk Management and Trading Strategies

Effective risk management involves setting stop-loss and take-profit levels to protect investments. Traders use chart analysis to identify entry and exit points, minimizing losses while maximizing gains.

Setting Stop Loss and Take Profit Levels

Setting stop-loss and take-profit levels is crucial for managing risk. A stop-loss limits potential losses by automatically selling a stock when it drops below a certain price. Conversely, a take-profit level ensures profits by selling when the stock reaches a target price. These levels help traders stick to their plan and avoid emotional decisions. They are essential tools for disciplined trading strategies.

Creating a Trading Plan

A trading plan is a detailed strategy outlining entry and exit points, risk tolerance, and goals. It helps traders stay disciplined and avoid emotional decisions. Key components include defining market analysis techniques, setting profit targets, and establishing risk management rules. A well-structured plan ensures consistency and improves decision-making, ultimately enhancing trading performance and accountability. It serves as a roadmap for achieving long-term financial objectives.

Chart analysis helps identify potential risks by spotting trends, support/resistance levels, and volume trends. By analyzing these elements, traders can anticipate possible market movements and adjust their strategies accordingly. This proactive approach minimizes losses and maximizes gains, ensuring a more secure trading environment. Effective risk management is crucial for long-term success in the financial markets;Managing Risk with Chart Analysis